Relevant:

- Vancouver Housing Market Implodes: Average Home Price Plunges 20% In 1 Month

- Housing Bubble In Full Bloom, Zany Price Increases, And Now A Sudden Slowdown

- Manhattan apartment prices top $2 million

- London House Prices Are Having Their Worst December in Years

- Toronto Housing Market May Need Vancouver-Style Cooling, RBC Says

2008-07-31 — ml-implode.com

by Adrian Ash — BullionVault

"...Finally the UK real-estate bubble is exploding. But how long – and deep – will the price deflation run from here...?"

WHO WILL SAVE the great British House-Price Bubble? I'd been calling the top for so long – as long-time Daily Reckoning UK readers will recall with a groan – that the crisis now upon us almost missed me by.

But "in the market for established homes, more transactions [are] falling through," reports the latest Summary of Business Conditions from the Bank of England, "with some estate agents reporting a cancellation rate of up to 40%."

Put another way, some parts of the UK – where national transaction volumes have already dropped 43% from their average of the last three-and-a-half decades – are seeing four-in-ten sales grind to halt after the deal is agreed.

"That was partly due to the unwillingness of many sellers to accept a lower offer," says the Bank's July report. Meaning that would-be buyers are under-cutting their initial bid, leaving vendors to either take it or leave it. But vendors remain in denial, meantime, about the true market-price of their homes in this fast-sinking market.

Central London has already seen prices lose 10% from last autumn. Nationwide, average sale prices have fallen 8%. But compare the average "asking price" tracked by Rightmove – the No.1 estate-agency website – with the actual "completion prices" recorded by the official Land Registry, and the gap between hope and reality continues to widen, rather than shrink. It reached almost £59,000 in June, a 24% discount off vendor intentions.

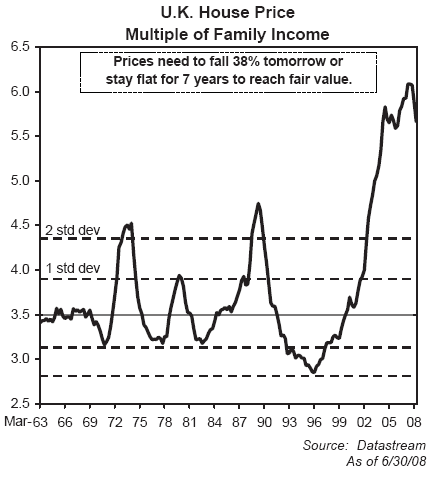

How come? Contrary to popular belief – egged on by central government, the media (not least Channel Four), and claims that the UK "needs" an extra three or maybe Five Million Homes by 2020 to meet demand – house prices don't always go up. Not with the average home costing a record 6.5 times average income by mid-2007.

And then, of course, came the credit crunch. Now, on the other side of the trade from would-be vendors, many potential buyers simply cannot raise a mortgage loan, let alone match the seller's over-inflated dreams of yesteryear's gains.

Anecdote here in London has that what US realtors would call "jumbo" mortgages now require the buyer to settle a minimum 25% of the sale price with a cash deposit.

Lenders will then advance a maximum half-million pounds. That effectively caps home prices in the capital at the apocalyptic level of £666,000...some $1.3 million.

Yes, that's more than twice the price of London's average semi-detached home (a quaint English expression meaning "a house with only one shared wall". American readers enjoying the average 2,250 square feet of US living space should consider that British homes are barely one-third that size. The most common alternative to "semi-detached" is a sardine-tin "terrace" with neighbors squashed right up against you on both sides.)

But the greatest lie of them all during this decade's historic bubble in prices was that the "trickle down" from high-end home buyers – numbering the Russian mafia, Euro-trash bankers and City traders fat on year-end bonuses – would keep the whole game running at any price for ever.

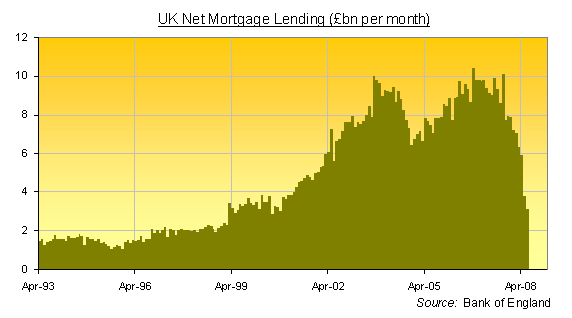

Fact is, in contrast, that the excesses higher up the housing ladder merely encouraged more modest subjects to beggar themselves trying to keep up. All told – adding personal loans and credit-card debt to outstanding mortgages – UK citizens now owe the banks some £1.44 trillion...roughly $2.8 trillion and well over 12 months of gross domestic product (GDP).

That's more than twice the outstanding debt owed in July 2001. The economy has grown a mere 24% since then. So at the top of the curve, with new debt growing by 14% year-on-year, every extra Pound borrowed resulted in just 10 pence growth in the economy.

Never before in history has any other nation even come close. At least the Tokyo real estate bubble ending in 1989 came against strong personal savings rates and a massive surplus in Japan's balance-of-payments.

Whereas now, and here...?

"The UK housing event is probably second only to the Japanese 1990 land bubble in the Real Estate Bubble Hall of Fame," writes Jeremy Grantham, co-founder of the GMO investment group in the late '70s. It now runs $126 billion in assets from Boston.

"While the US is a newcomer to housing bubbles," he goes on in his latest client letter, "the Brits are old pros. It's practically their national past time.

"1973 and 1989 were the peaks of two handsome, fairly symmetrical housing bubbles in the UK. [Now] house prices could easily decline 50% from the peak, and at that lower level they would still be higher than they were in 1997 as a multiple of income. It will make our troubles look like a toothache to their hip replacement.

What's more, "unfortunately for global financial well being," notes Grantham, "the UK is not Iceland, but a major player in the global banking business, so the scale of the write-downs will produce yet another wave of destabilization."

Watch out below!

Adrian Ash

Gold price chart, no delay | Free Report: 5 Myths of the Gold Market

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK's leading financial advisory for private investors, Adrian Ash is the editor of Gold News and head of research at BullionVault – where you can Buy Gold Today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c)BullionVault 2008

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

source article |

permalink |

discuss |

subscribe by:

![]() |

|

![]() RSS |

email

RSS |

email

Comments: Be the first to add a comment

add a comment | go to forum thread

Note: Comments may take a few minutes to show up on this page. If you go to the forum thread, however, you can see them immediately.